Summary Background

DEMOGRAPHICS

Total Population

78,905

Long Beach Opportunity Zones

Unemployment Rate

9.53%

Long Beach Opportunity Zones

Percent College Educated

14.16%

Long Beach Opportunity Zones

Labor Force Participation Rate

61.41%

Long Beach Opportunity Zones

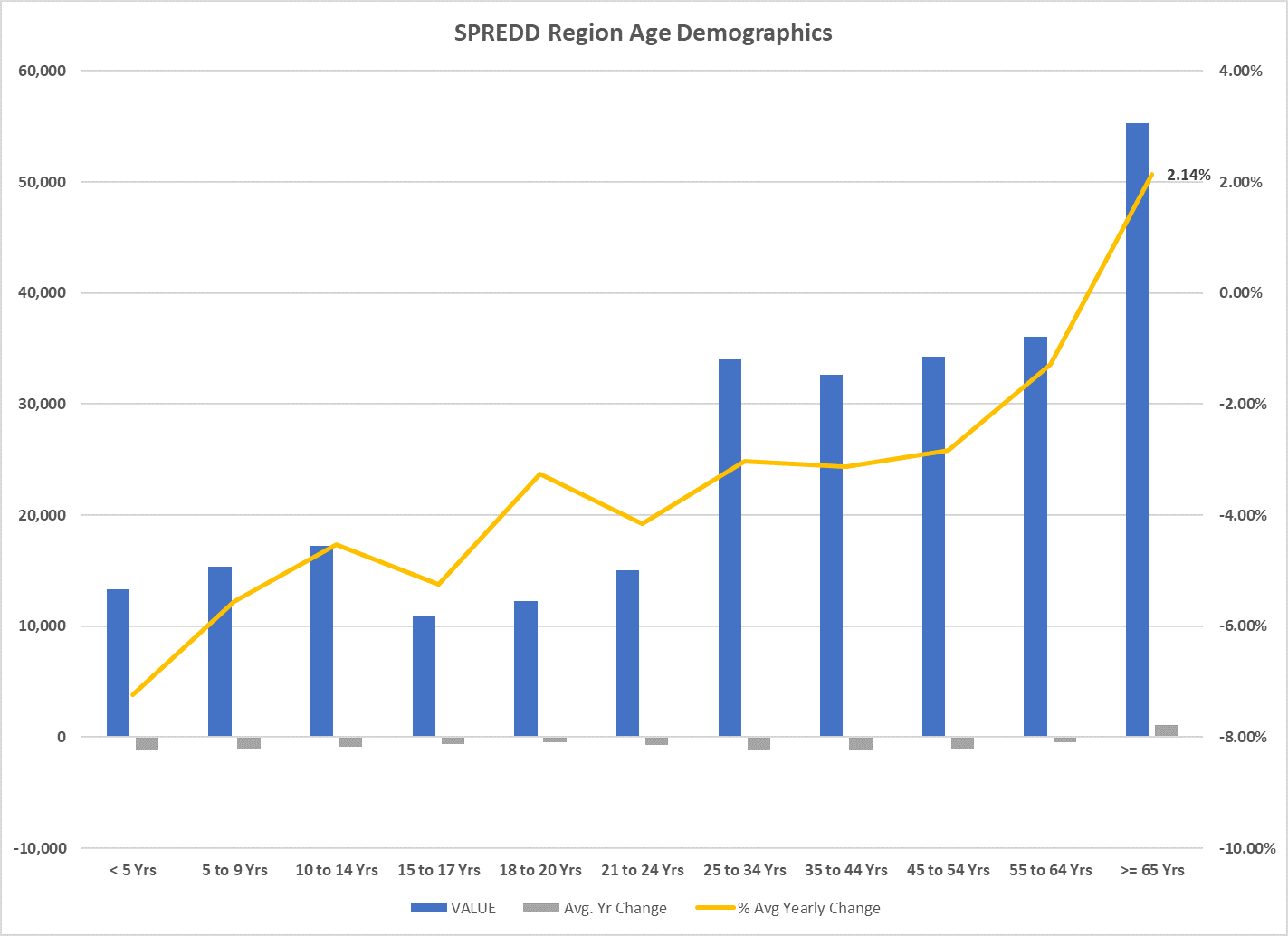

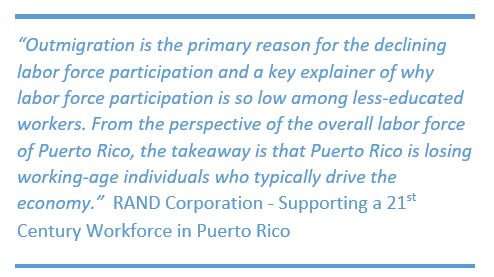

According to many stakeholders, younger persons will move to the U.S. for economic opportunities, and many return to Puerto Rico to retire or possibly care for ailing parents. Chart 7 indicates this pattern occurs in the SPREDD region, as the only age group increasing are those 65 years and over. The highest levels of out-migration are among those 25 to 44 years of age. This pattern of out-migration by the young (for economic opportunities) and returning to the Island to retire are contributing factors to Puerto Rico’s low Labor Force Participation Rate, which is currently[1] 40.3% according to the Economic Development Bank for Puerto Rico. By contrast, the U.S. Labor Force Participation Rate is currently 61.5%.[1]

LFPRs by municipalities in Puerto Rico are not calculated; however, using labor force numbers from the Puerto Rico Department of Labor and Human Resources for the six municipalities and the population 18 and over (Chart 7), the estimated LFPR for SPREDD is 36.9%.

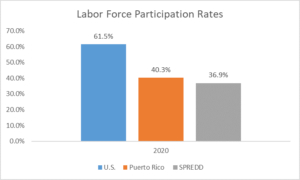

With respect to housing units in the SPREDD region, according to the U.S. Census, there are 128,362 units.[1] Various news accounts and stakeholder interactions indicate that over 8,000 housing units were damaged as a result of the earthquakes. A conventional indicator of U.S. housing affordability is the percentage of income spent on housing. Housing expenditures that exceed 30% of household income have historically been viewed as an indicator of a housing affordability problem, according to the University of Pennsylvania’s Wharton Real Estate Center. The 30% of household income metric is also cited by the U.S. Census Bureau as a key affordability metric.

Based on the 30% of household income metric, there appear to be adequate affordable rental units in all six municipalities.

The highest percentages of the workforce are employed in Public Administration and Retail. Manufacturing also continues to be a significant component of the workforce, comprising 12% of the workforce and comprising the most significant wage base. The largest employers in the region are outlined in Table 4. The data is the latest available from the Puerto Rico Department of Labor made available to SPREDD, which is as of Q3 2019.

Based on the Q3 2019 data, the largest private employer in the SPREDD region is CooperVision, a manufacturer of contact lenses at its facility in Juana Díaz. According to CooperVision’s latest annual report, its facility in Juana Díaz is 527,285 square feet and represents its second-largest global facility. In addition to manufacturing, CooperVision also performs research, development, and distribution at its Juana Díaz facility.

The second-largest private employer in the region is Point Blank Protective Apparel (PBPA), which produces military uniforms at its facilities in Gaunica. The LQ (establishments) for Gaunica for NAICS 315210, Cut and Sew Apparel Contractors is 36.58. The Berry Amendment (USC, Title 10, Section 2533a), restricts the Department of Defense (DoD) from using funds appropriated or otherwise available to DoD for procurement of food, clothing, fabrics, fibers, yarns, other made-up textiles, and hand or measuring tools that are not grown, reprocessed, reused, or produced in the United States. Items produced or assembled in Puerto Rico are Berry Amendment compliant.

Another significant employer noted in Table 4 is U.S.S.C. Puerto Rico, Inc., which is part of Medtronic (NYSE:MDT), which develops, manufactures, and markets medical devices.

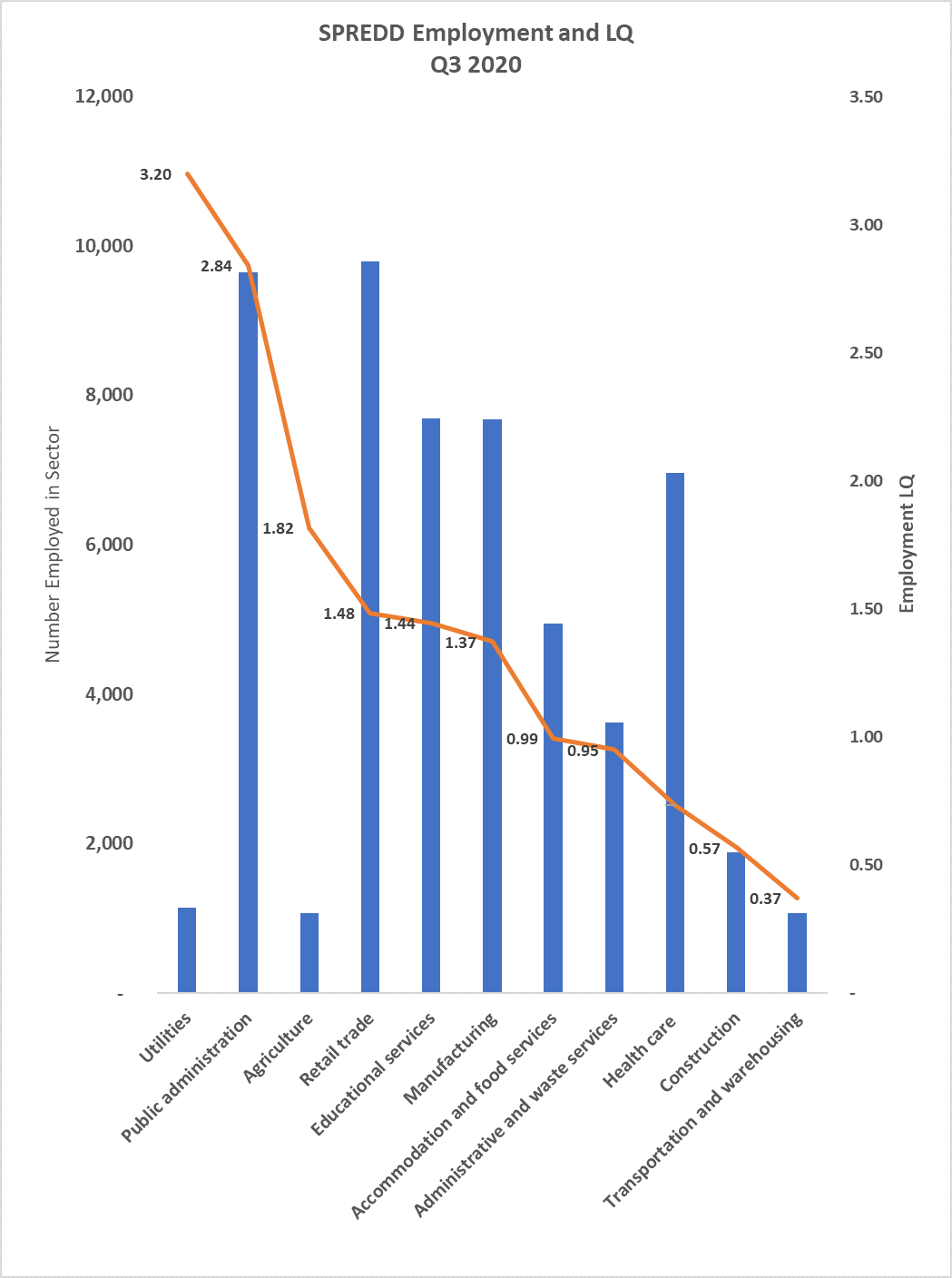

Chart 10 presents the sectors by means of their employment and associated Location Quotient (LQ). The LQ represents is a way of quantifying how concentrated a particular industry, cluster, occupation, or demographic group is in a region as compared to the nation. Typically an LQ > 1.0 indicates a particular product or service is exported, whereas an LQ close to 1.0 means is it sufficient, and an LQ < 1.00 may indicate a particular industry’s goods or services are imported.

The highest LQ noted was 3.2 for the Utility sector, as the primary electricity-generating assets for all of Puerto Rico are located in SPREDD’s region. The second-highest LQ was Public Administration. Because government services are not likely “exported” from the region, as may be the case with a capital city, etc. this may be a sign of excess employment in this sector. Comparable data on municipal employment on a per-resident basis also indicates over-employment in the sector. For example, the Autonomous Municipality of Ponce is the second-largest employer in the region, with 2,226 employees, or one employee for every 59 residents. According to CityStats, for cities with more than 60,000 residents, there is typically one employee for every 112 residents. Stakeholders have noted over-regulation and a burdensome permitting process are hindrances to economic development.[1]

The six municipalities comprising the SPREDD region have withstood an enduring recession, multiple natural disasters, outmigration of talent, a pandemic, high unemployment, high poverty, and are further burdened with an inability to enter the capital markets because of the on-going Title III reorganization. Despite these extreme challenges, the region has underutilized assets that can be keys to building an enduring economy. There is significant need for the enhanced cooperation and capacity building made possible by an EDD.

The Health and Social Services sector has considerable establishments and employees; however, it does not register as a “traded” sector, meaning the LQ > 1.

[1] One of the most recurring themes from stakeholder interviews and surveys was the “excessive” bureaucracy and “broken” permitting process. This does not reflect the opinion of the authors of this CEDS, but the comments received from stakeholders.

[1] 2019 U.S. Census Bureau; 2019 American Community Survey 5 Year Estimates

[1] BLS February 2021

[1] February 2021

WHY IS THIS IMPORTANT?

Discuss resiliency issues and measures here.

Chart 7: SPREDD Age Demographics Source: U.S. Census Bureau; 2019 American Community Survey 5 Year Estimates

Your Title Goes Here

Chart 8: Labor Force Participation Rates 2020 Sources: BLS, Economic Development Bank for Puerto Rico, Puerto Rico Department of Labor and Human Resources and U.S. Census Bureau

Chart 9: Housing data; Source: U.S. Census Bureau; 2019 American Community Survey 5 Year Estimates

Table 3: Summary of establishments with employees, employment and wages in the six municipalities represented by SPREDD. Source: U.S. Bureau of Labor Statistics, Quarterly Census of Employment and Wages Q3 2020.

Table 4: Largest Employers in SPREDD Region. Source: Puerto Rico Department of Labor Q3 2019

Chart 10: SPREDD Employment and LQ; Q3 2020 Source: U.S. Bureau of Labor Statistics QCEW